Overhead Percentage is an accounting and project management key

performance indicator that measures how much you need to collect from each

customer in addition to each one dollar of direct labor billed for the products

or goods to cover the costs for doing business. Overhead Percentage can be

found by:

Overhead Percentage = Indirect Expenses/Direct Expenses

Direct Expenses are income producing costs for labor and materials that

are directly tied to the production of goods or services.

Indirect Expenses (or Overhead Expenses) are non-income producing costs

that are not associated with the production process or services provided by the

company, for example, advertising, taxes, rent, utilities, salaries of indirect

labor employees (accounting department staff members), etc.

You can track Indirect Expenses (or Overhead Expenses) entering them

manually for each task associated with Indirect Expenses.

Alternatively Indirect Expenses (or Overhead Expenses) can be calculated

by the formula:

Indirect Expenses (or Overhead Expenses) = Total Expenses – Direct

Expenses

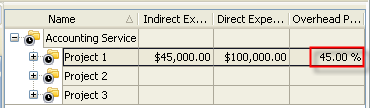

Overhead Percentage is an essential KPI because it lets you decide on

pricing strategy, calculate a selling price for products and services and

protecting company’s Operating Margin. For example, Overhead Percentage is 45%.

It means that for every $1.00 USD of direct labor billed to the customer, you

need to collect additional $0.45 USD ($1.00 x 45%) from that customer just to

cover the costs associated with the salaries of indirect

labor employee, taxes, rent, power supply, etc.

To calculate Overhead Percentage please follow

the steps described below:

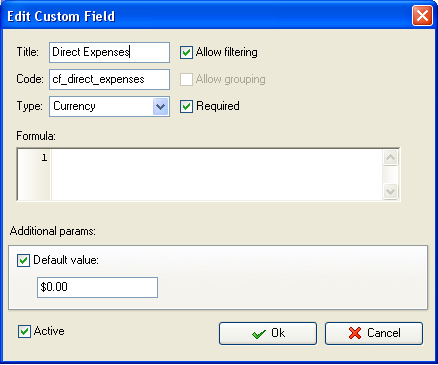

- Create the

custom field "Direct Expenses" with the code "cf_direct_expenses"

Add direct labor, raw materials and other costs related to producing

goods or services.

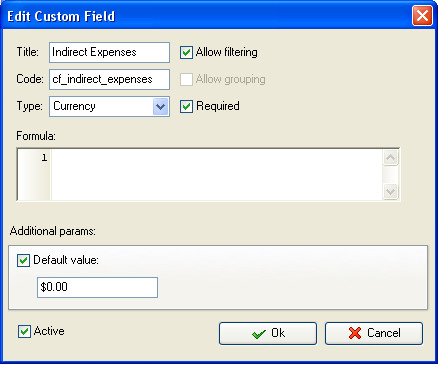

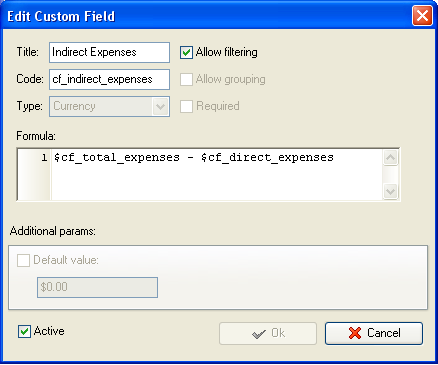

- Create the

custom field "Indirect Expenses"

Add all indirect labor expenses, taxes, rent, phone and other expenses

that are not linked directly with manufacturing of products or services.

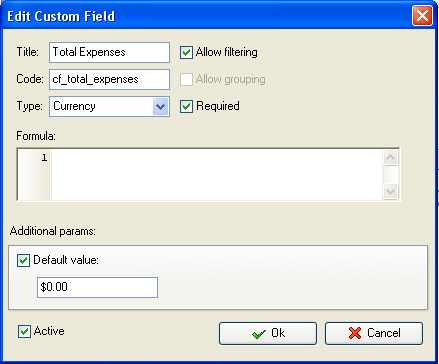

Note: If you would like to measure "Indirect Expenses" by the formula:

Indirect Expenses (or Overhead Expenses) = Total Expenses – Direct

Expenses, you need to create a custom field "Total Expenses" with the code

"cf_total_expenses".

- Create the

custom field "Indirect Expenses" with the following formula:

$cf_total_expenses - $cf_direct_expenses

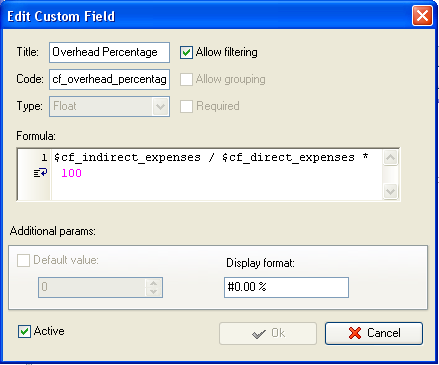

- Create the

custom field "Overhead Percentage" with the formula:

$cf_indirect_expenses / $cf_direct_expenses

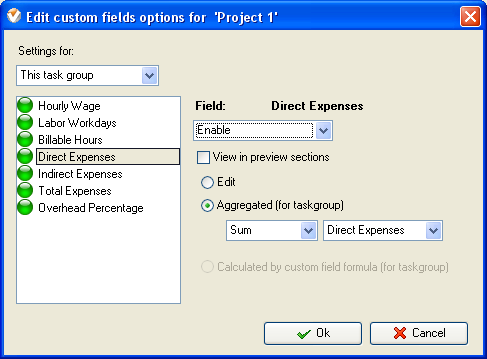

- On Task Tree select the task group for which you need to display Overhead

Percentage and select "Custom fields options"

- Set the following custom fields settings for the following custom

fields: "Direct Expenses" and "Indirect Expenses"

- In "Settings for" select "This

task group"

- select "Enable"

- in "Aggregated (for task

group)" field select "Sum" from drop-down list and the corresponding custom

field name

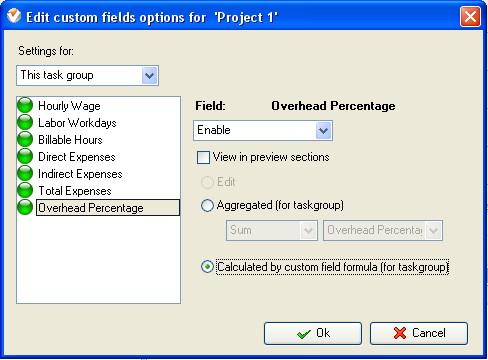

- Select custom field "Overhead Percentage" set the following settings for these custom fields:

- In "Settings for" select "This task group"

- select "Enable"

- select "Calculated by custom field formula (for task group)"

Overhead Percentage KPI on Task Tree